記事の目次

Is it even necessary to test in FX trading?

The answer is definitely yes!

The typical flow from the start to the end (settlement) of an FX trade involves “analyzing,” “taking a position using a strategy,” and “settling.”

Analysis in FX Trading

First, it usually starts with chart analysis (technical analysis).

The analysis methods typically include the Dow Theory, with a focus on moving averages, trend lines, and support/resistance lines, as well as the use of indicators.

While the analysis methods vary from person to person, you generally interpret the charts in your own way to predict future movements.

This is what is referred to as the analysis process in FX trading.

What is a Method in FX Trading?

Next, you assess whether the price will continue to move in the direction predicted by your analysis when the actual price reaches the price range derived from your analysis.

The criteria for making a decision when the chart looks a certain way is known as the “method.”

Here, many people use a combination of chart patterns and price actions according to their own style.

Taking a Position and Making a Decision on Settlement

Up to this point, you have done the analysis and, when the price reaches that price range, you decide whether to take a position using your own method. Once you determine that the chart has started moving in the expected direction, you start trading.

After taking a position, the important steps are to set stop-loss points and settlement points and wait.

The above is the basic flow from the start to the settlement of a trade.

However, if it were just for one trade, there would be no need for testing.

To Win Consistently, Verification with Testing Software is Essential

However, the reason I’m involved in FX trading is to “make money.”

Winning a single trade here and there doesn’t amount to much.

It’s crucial to keep winning consistently in FX.

Initially, I managed to make some profits just by analyzing charts in my own way and trading based on those analyses.

But, even though I hadn’t changed my analysis method, my success was inconsistent, and eventually, I lost all my capital and had to deposit more.

In hindsight, it’s obvious why this happened, isn’t it?

As someone who started out as a complete novice with no knowledge of FX, using methods from books or online information without any solid foundation, there was no way I could consistently win.

Indeed, FX charts do exhibit patterns, and there are times when similar trends appear.

However, that doesn’t mean the chart will always behave the same as it did before—it’s never 100% the same!

This means that even if you analyze in the same way each time, sometimes the results align with your analysis, and sometimes they don’t.

That’s why it’s crucial to know how reliable your trading strategies are, based on your analysis.

After all, you’re betting your own money on this. If you started FX trading to make money but ended up losing it, that defeats the purpose.

The way to understand how well your trade analysis and methods work in FX is through backtesting.

For more details on the importance of backtesting in FX and how to do it correctly, please refer to another article.

How Useful Testing Software Like Forex Tester Can Be

I aim to continue winning consistently and trade with confidence.

To achieve this, I believe that backtesting and verification are necessary.

I usually use the standard MT4 for FX trading, which is sufficient for backtesting.

Depending on the time frame, you can view charts from over six months ago, even on the one-hour chart, which is usually enough.

However, to trade confidently, it’s necessary to test whether the chart patterns and line-drawing methods discovered during backtesting are actually effective using testing software based on past data.

The result of testing with the software will give you the “win rate of that trading strategy.”

I believe that this win rate, obtained through thorough testing, provides the foundation for trading confidently (and winning consistently).

Free Software for Backtesting with Historical Data

There are free software options for backtesting with historical FX data, like “ThinkTrader.”

MT4 itself also has some indicators that can be used for backtesting.

I tried using free software (ThinkTrader) for backtesting because I wanted to keep costs down, but it was really inconvenient and frustrating.

As a result, my critical backtesting process became haphazard and meaningless due to the stress and hassle.

I suspect that others, like me, want to minimize initial costs, so they start with free software. However, dissatisfaction may lead to neglecting or rushing through the verification process.

How Convenient Paid Testing Software Can Be

So, what happens if you opt for paid software?

I did a lot of research before purchasing Forex Tester 4. I read online articles, checked Twitter and YouTube, and asked acquaintances who use paid software because I didn’t want to make a mistake.

The result of my search was Forex Tester.

It’s incredibly convenient.

Here are some points that I personally find extremely useful.

- Candlestick rewind

- Upper and lower limits for the speed at which the chart advances

- Multi-time frame analysis possible

- Share moving averages and lines across multiple time frames

- Accurately reproduces VIP data for 1 minute

There are many other features unique to paid software, but these are the standout ones that are not available in free software, or if they are, the difference in precision is evident.

For backtesting, it is crucial to ensure that the “analysis methods you normally use can be accurately reproduced” and that “the price fluctuations are based on real historical data.”

If the accuracy of either of these aspects is low, the overall quality of the backtesting will be compromised, rendering it meaningless.

Downloading Forex Tester, Purchasing a License, and Registering the Registry Key

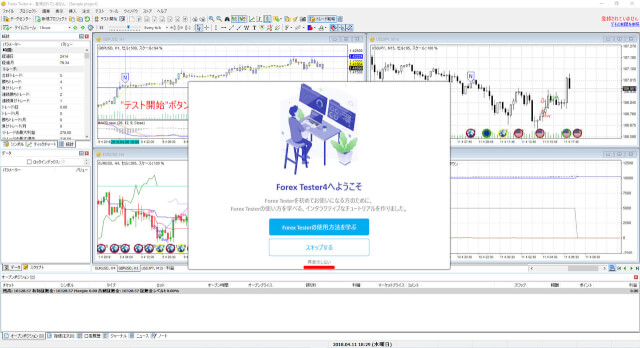

Now, let’s go through the steps for downloading Forex Tester 4, purchasing a license, and registering the registry key in the software.

Downloading Forex Tester 4

First, you need to download the Forex Tester software, which you can do from the official Forex Tester website.

Even if you don’t want to purchase the paid version right away, there is a free “trial version” available. If you want to try it out first, I recommend downloading the trial version.

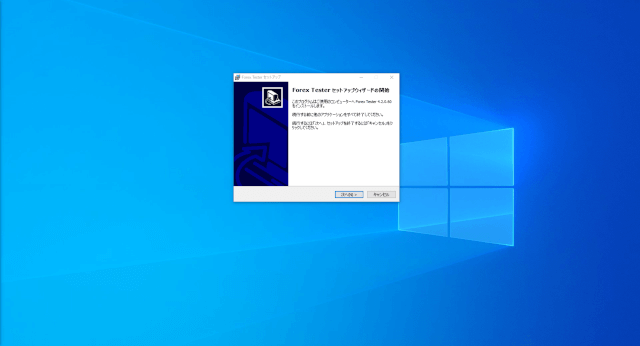

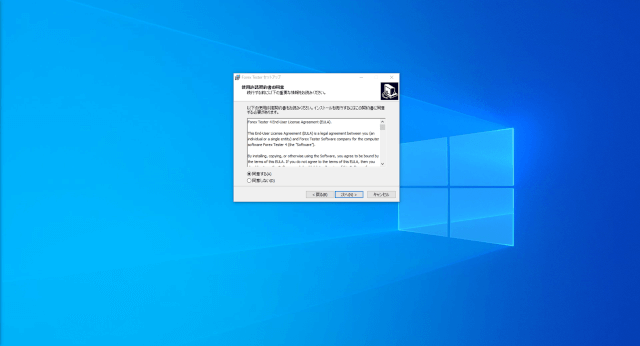

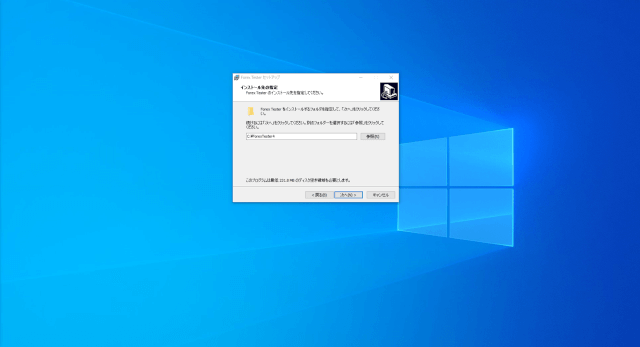

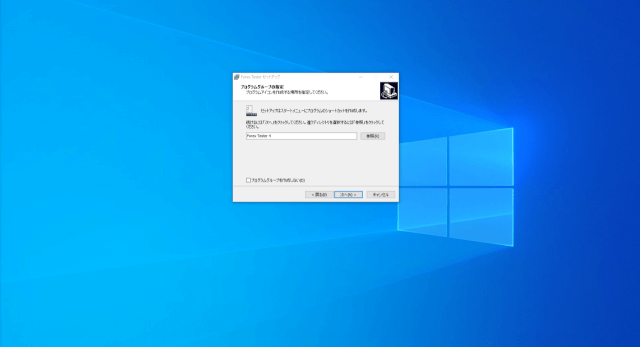

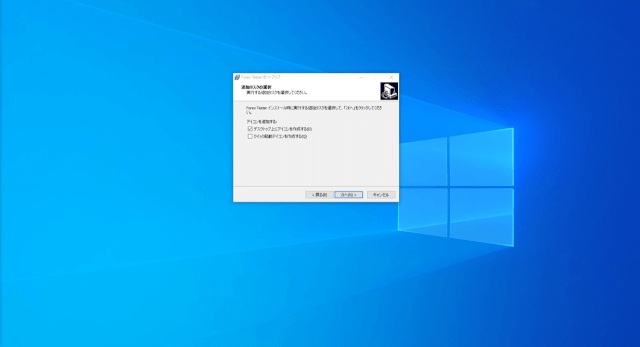

Installing Forex Tester on Windows

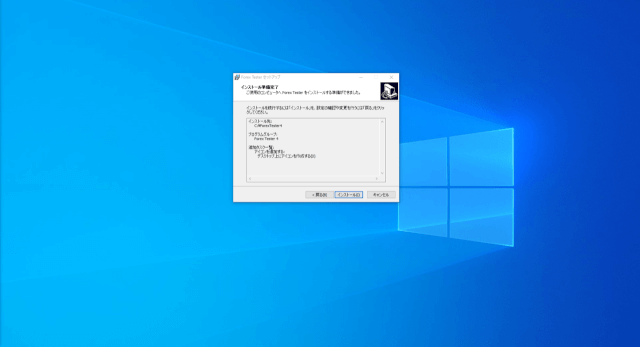

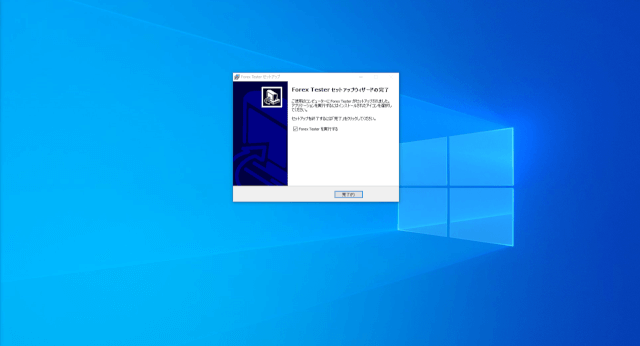

Once you run the downloaded Forex Tester file, the setup wizard will start. Just follow the instructions.

You can choose where to install Forex Tester, but I went with the default location.

With that, the installation is complete.

Purchasing a Forex Tester License

After downloading and installing Forex Tester, you need to purchase a license to get the registry key issued.

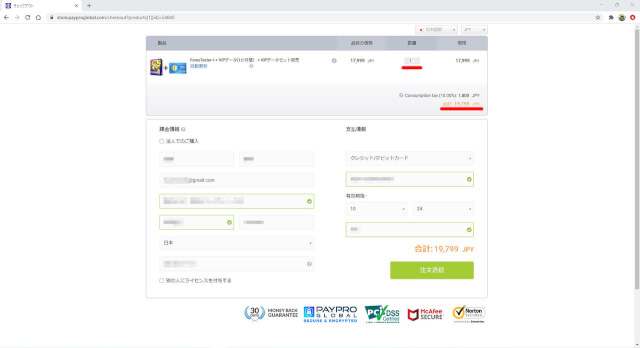

There are several license options, which can be broadly categorized as follows:

- Data Update Period: Forex Tester allows you to update and obtain the latest data (up to the previous day) daily. The period for which you can update to the latest data from the purchase date comes in three options: one month, one year, and lifetime.

- Precision of Historical Data: There are three levels of data precision you can choose from—Basic, Standard, and VIP. The VIP level includes tick data reproduction.

The tick data allows you to clearly see the price movement even within 1 minute.

For those who want more details, please check the official website.

Additionally, the data update subscription for Forex Tester is set to auto-renew. If you no longer need the latest data, you can cancel the auto-renewal through the cancellation form.

Be sure to verify the quantity and total amount before confirming your order.

When I made my purchase, there was a Halloween campaign, so the price was about half off!

Receiving the Invoice and Registry Key After Purchasing Forex Tester

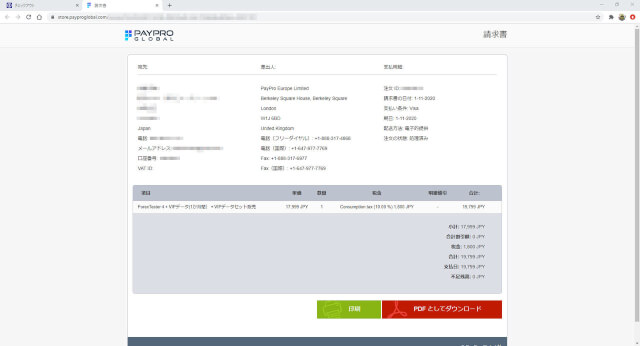

After completing the purchase process mentioned earlier, you’ll promptly receive an email with the invoice and the registry key sent to your registered email address.

Invoice Details

The invoice is well-documented, which is useful if you need to submit it for expense reimbursement.

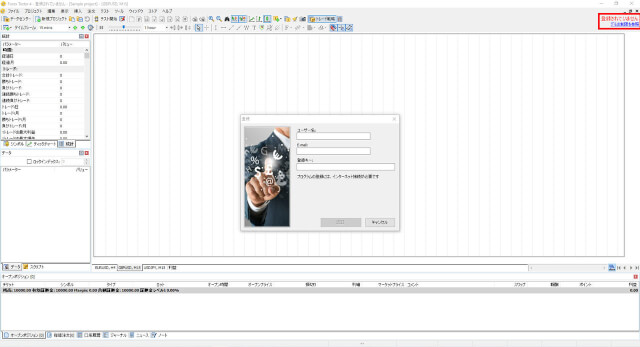

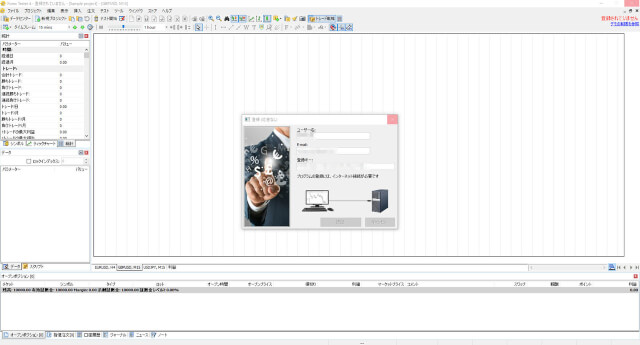

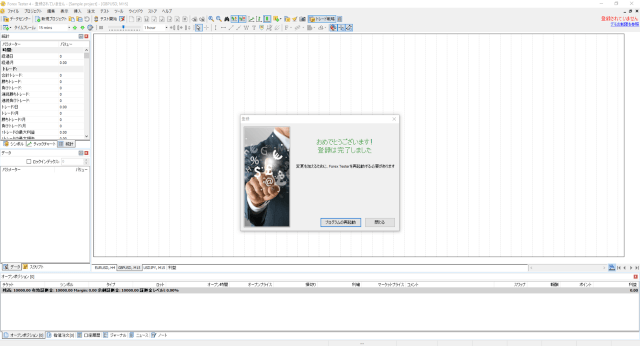

Registering the Registry Key in Forex Tester

The last step is to register the registry key.

There’s also a tutorial available when you first start Forex Tester, which is quite helpful. However, I skipped it.

Once the tutorial is finished, click on “Help -> Register Program” on the far right of the menu. Then, enter the registry key, username (you can use Japanese), and email address you received via email, and you’re all set.

Depending on your internet connection, it might take a little time or fail initially, but you should be able to complete the registration after a few tries.

Impressions of Purchasing Forex Tester, a Multi-Time Frame FX Backtesting Software

To actually start backtesting, you need to download the historical data for the currency pairs you want to test. I started by downloading only the GBP/JPY data.

For more information on downloading historical data or canceling automatic updates, please refer to the article linked below.

I’ve only used it a few times so far, but it’s incredibly convenient and efficient for backtesting.

While it’s slightly different from the MT4 platform I use for actual trading, the operation and screen layout are almost the same. The ability to perform multi-time frame analysis is particularly valuable.

I don’t use any special indicators regularly, so I can achieve win rates with the exact same analysis methods and strategies.

When trading with a thoroughly backtested strategy, I believe you can maintain a more stable mindset, and if you can consistently increase your profits, the cost of Forex Tester can be easily recouped.

Even if you find one reliable strategy, the win rate of that strategy may decline over time as long as you continue trading FX. You might also want to explore other strategies.

Knowing that you will continue to use it in the future, I recommend purchasing a reliable backtesting software from the start.

23 Years of Actual Historical Data

Tick Data for Timeframes Below 1 Minute

Comprehensive Support System