Hello, good evening, and long time no see! It’s Pippi here (*´∇`*)

I’ve been quite busy with real trading recently and couldn’t allocate time for backtesting, so this article is a bit delayed.

However, I have finally completed the backtesting of the “Strong Rate Zone Targeting Method.” I’d like to share the backtesting results and the details of the re-analysis.

The background and reasoning behind establishing this trading strategy were discussed in a previous article, so I recommend checking that out first for a better understanding.

Let’s go then

記事の目次

- 1 Currency Pairs and Period Settings for Backtesting the Strong Rate Zone Targeting Method

- 2 Backtesting Trading Rules for the Strong Rate Zone Targeting Method

- 3 What Were the Results of Backtesting the Strong Rate Zone Targeting Method?

- 4 Reanalyzing the Backtesting Results of the Strong Rate Zone Targeting Method

- 5 Summary of the Backtesting Results for the “Strong Rate Zone Targeting Method”

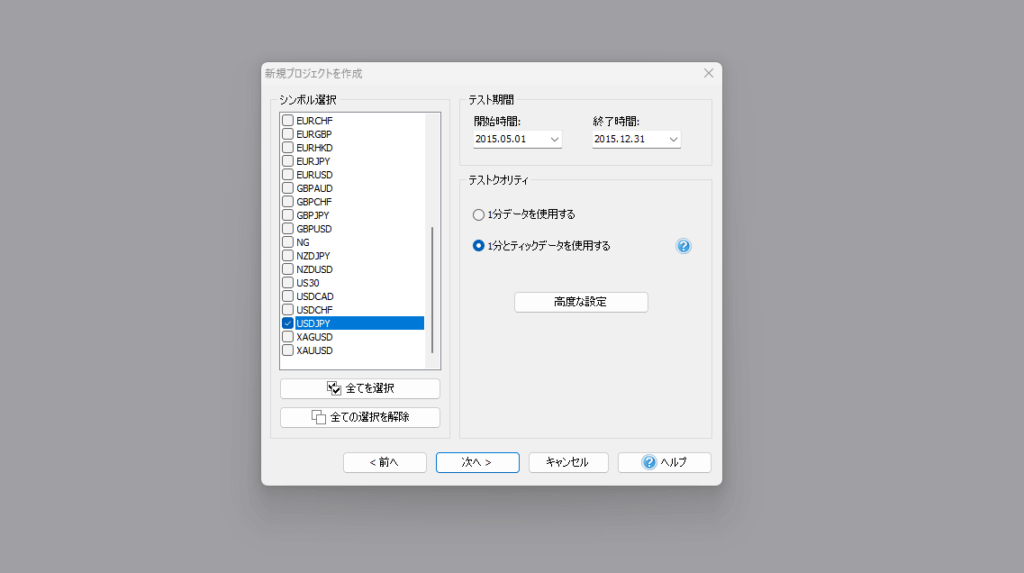

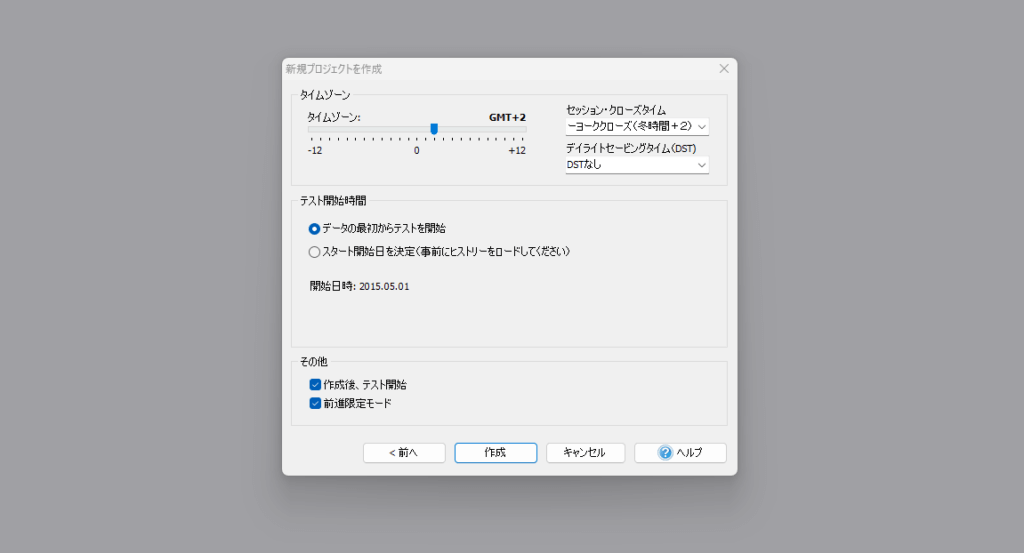

Currency Pairs and Period Settings for Backtesting the Strong Rate Zone Targeting Method

| Currency pair | USDJPY |

| Main axis time frame | Multi-timeframe analysis with the 1-hour chart as the main timeframe. Entry on the 5-minute chart. |

| Verification period | From May 2015 to December 2015. |

Since the main timeframe for this trading strategy is the 1-hour chart, I believe it’s sufficient to set a relatively shorter backtesting period to gather enough records.

One of the advantages of using backtesting software is that it allows for efficient trading verification by shortening the backtesting period for each strategy and main timeframe(,,>᎑<,,)

\\Currently on half price sale//

Backtesting Trading Rules for the Strong Rate Zone Targeting Method

Next, let’s review the trading rules for the strategy to be backtested.

- Target the high and low prices that have previously stopped or changed the flow of the market.

- Focus on markets where the trend and the respective highs and lows are easy to identify for anyone.

- Enter the trade when the price returns to the rate zone identified as strong.

- Set the stop-loss 10-20 pips from the entry rate zone.

- The take-profit target is the nearest high or low from the strong rate zone.

- Skip the trade if the risk-reward ratio calculated from the take-profit target is less than 1:1.

We will backtest using these trading rules. Depending on the results, we may reanalyze winning and losing trades to develop rules that further stabilize the win rate.

What Were the Results of Backtesting the Strong Rate Zone Targeting Method?

You might be wondering, “How can you reveal the backtesting results so quickly?” Well, this is precisely the value of our site, where we introduce trading strategies swiftly and effectively.

Without further ado, let’s dive into the results.( ー`дー´)キリッ

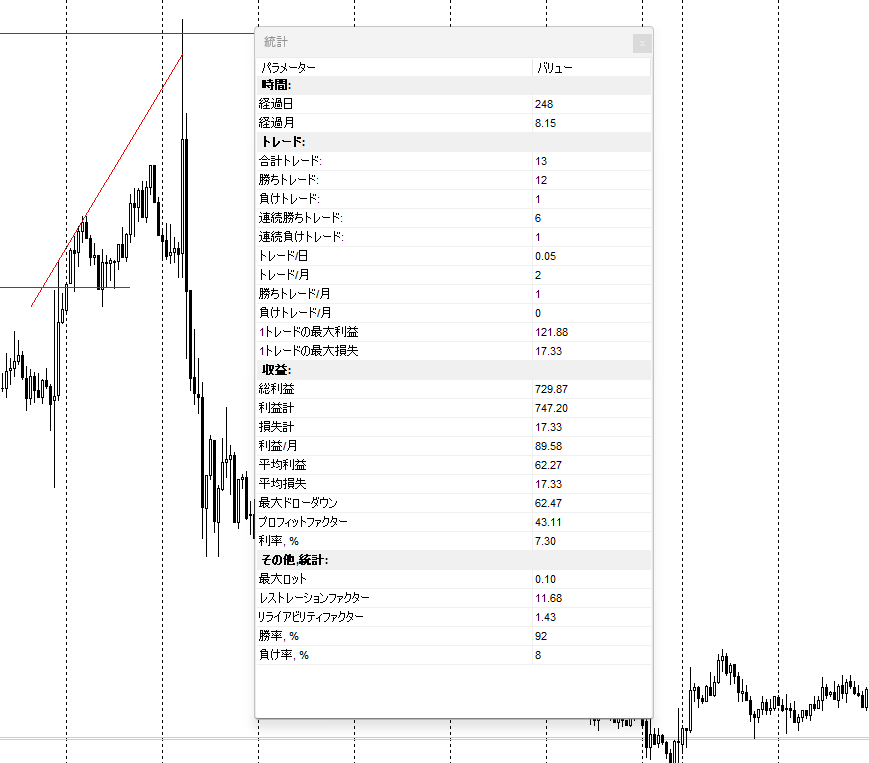

| Past verification statistical data | |

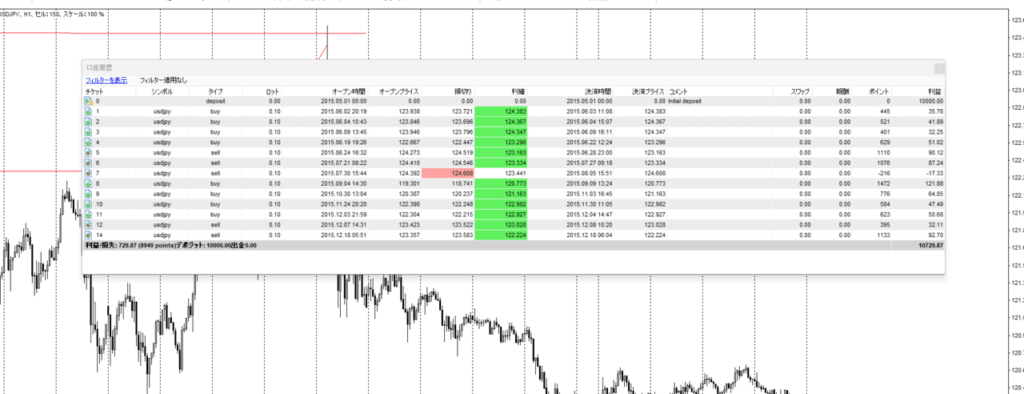

| Total number of trades | 13 trades |

| Number of winning trades | 12 trades |

| Number of losing trades | 1 trades |

| Winning rate | 92% |

| Losing rate | 8% |

| average profit | $62.27 |

| average loss | $17.33 |

| total profit | $729.87 |

| risk reward(RR) | 1:3.6(Calculated from average profit and average loss) |

What Do You Think?

Even I was surprised by the win rate after backtesting it myself.Σ(゜ω゜)ビクゥ

In addition to this impressive win rate, the risk-reward ratio is over 3:1, making it one of the most advantageous trading strategies we’ve introduced on this site.

However, with only 13 trades over 8 months, the frequency of 1.6 trades per month feels a bit low for my personal preference. Nevertheless, there are ways to address this, such as lowering the main timeframe. Ultimately, in forex trading, the goal is not to trade frequently but to make a profit, so this might not be an issue.

Reanalyzing the Backtesting Results of the Strong Rate Zone Targeting Method

The backtesting results are excellent, making further analysis seem unnecessary. However, revisiting the results helps reinforce the strategy for myself, so I’ll go ahead and do it.

You Can Enter Multiple Times at a Strong Rate Zone

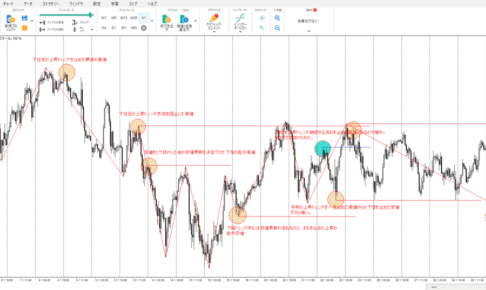

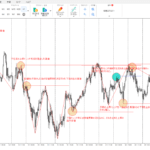

This point reflects on the entry conditions of three consecutive winning trades at the start of the backtest.

The reason I judged the rate zone as strong is explained within the chart images.

The take-profit was set according to the strategy, using the price range from the previous high to the low identified as the strong rate zone, and it successfully reached the take-profit target.

Just from this rate zone, three consecutive entries resulted in approximately 50 pips of profit each.

While this is somewhat hindsight, considering the market was in a continuous uptrend, the take-profit target could have been set higher.

In particular, for the second trade, the price extended more than double the take-profit target, which in retrospect feels like a missed opportunity.

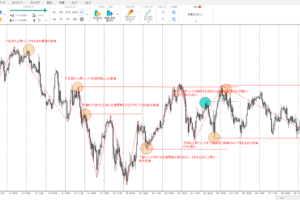

Clearly Defined Highs and Lows That Halt Strong Uptrends or Downtrends Become Strong Rate Zones

Next, let’s review a trade that secured approximately 60 pips of profit.

As detailed in the chart image, the low point that halted a significant downtrend clearly became a strong rate zone. This wasn’t just true for this instance but also for subsequent market movements, making it a consistently significant area. While take-profit decisions can be challenging in such cases, it’s worthwhile to enter the trade when these zones are retested.

During the backtest, I didn’t enter at this point, but as the chart image shows, an entry at the initial test would have resulted in an additional winning trade, thus improving the win rate further.

Summary of the Backtesting Results for the “Strong Rate Zone Targeting Method”

What did you think?

This strategy produced outstanding results, standing out among all the strategies I’ve introduced and backtested so far.v(。-_-。)vブイッ♪

As you can see, the trading rules are simple and based on identifying strong rate zones in the market. This makes the strategy robust and easily replicable for anyone.

Moreover, the backtesting results confirmed the strategy’s edge, so I highly recommend giving it a try.

The specific trading rules are outlined here. If you want to use the “Strong Rate Zone Targeting Method,” consider incorporating it into your trading strategy with backtesting software before applying it in real trading.

I’ve also written a separate article on ForexTester, covering everything from how to download it to how to use it for free monthly. Please give it a read.

の使い方を分析してみたら勝率56.7のトレード手法が見つかった-300x200.jpg)

のシンプルトレンドフォロー手法を確立させるまで-300x200.jpg)